Previously I wrote about the NY Times opinion piece, “Should the Fed Guarantee You a Job?”, the article proposed a government-funded program that would guarantee participants government jobs. Read my response “Back to Work – Job Guarantee”. With this past year being devastating to many American businesses and families, finding ways to provide new employment opportunities is crucial to our country’s economic recovery. I proposed that we merge the Work Opportunity Tax Credit and the Educational Income Tax Credit (found in Pennsylvania) to create a new tax credit solution for training skilled workers. What if a business or individual could contribute to a 501(c)(3) organization that provides job training services to low-income households and receive a tax credit for it? It would allow low-income families to learn a skill necessary for steady income provided through private-sector work. You don’t have to search very hard to observe that we have a shortage of skilled trade labor in our country. Could this solution also help us close that gap?

Congressman Smucker of PA’s 11th district, who serves on the Ways and Means Committee, sponsored a bill, HR 1739 – “USA Workforce Tax Credit Act” in the 2019-2020 session, which aimed to address workforce development and apprenticeship training. In addition to Congressman Smucker, Mr. Mooney of West Virginia, Ms. Stefanik, Mr. Budd, Mr. Gaetz, Mr. Collins of New York, Mrs. Lesko, and Mr. Kustoff of Tennessee introduced the bill. This bill should be presented to congress again as it is the right time for such action. In this bill, businesses or individuals would receive a tax credit for a contribution to qualifying workforce development or apprenticeship training organizations. The bill functions similarly to the EITC program, which has been very successful in Pennsylvania. If the bill doesn’t make it through federally, I would love to see it implemented in Pennsylvania.

What is a workforce development or apprenticeship training program?

A Workforce Development or Apprenticeship Training organization could include

- Community Colleges

- Workforce Training Programs (defined by State workforce agencies)

- Organizations that provide career and technical education

- Organizations that provide training or apprenticeships

- Community organizations that provide full certified training

- Private schools that confer diplomas, degrees, or certify completion of certain grades

What is a scholarship granting organization?

A scholarship granting organization is a qualified elementary or secondary education organization whose exclusive purpose is to provide tuition scholarships for eligible student’s qualified expenses. This organization provides scholarships to more than one student and different students attending more than one school.

How do you qualify?

The only requirement for eligible participants is to be enrolled in a workforce or apprenticeship training organization as previously outlined. To qualify for a scholarship from an educational organization, the recipient must be a household member whose combined income is below 200% of the median gross income as determined by the Secretary of Housing and Urban Development. In 2019 the median household income was $68,703.

How does this benefit Americans?

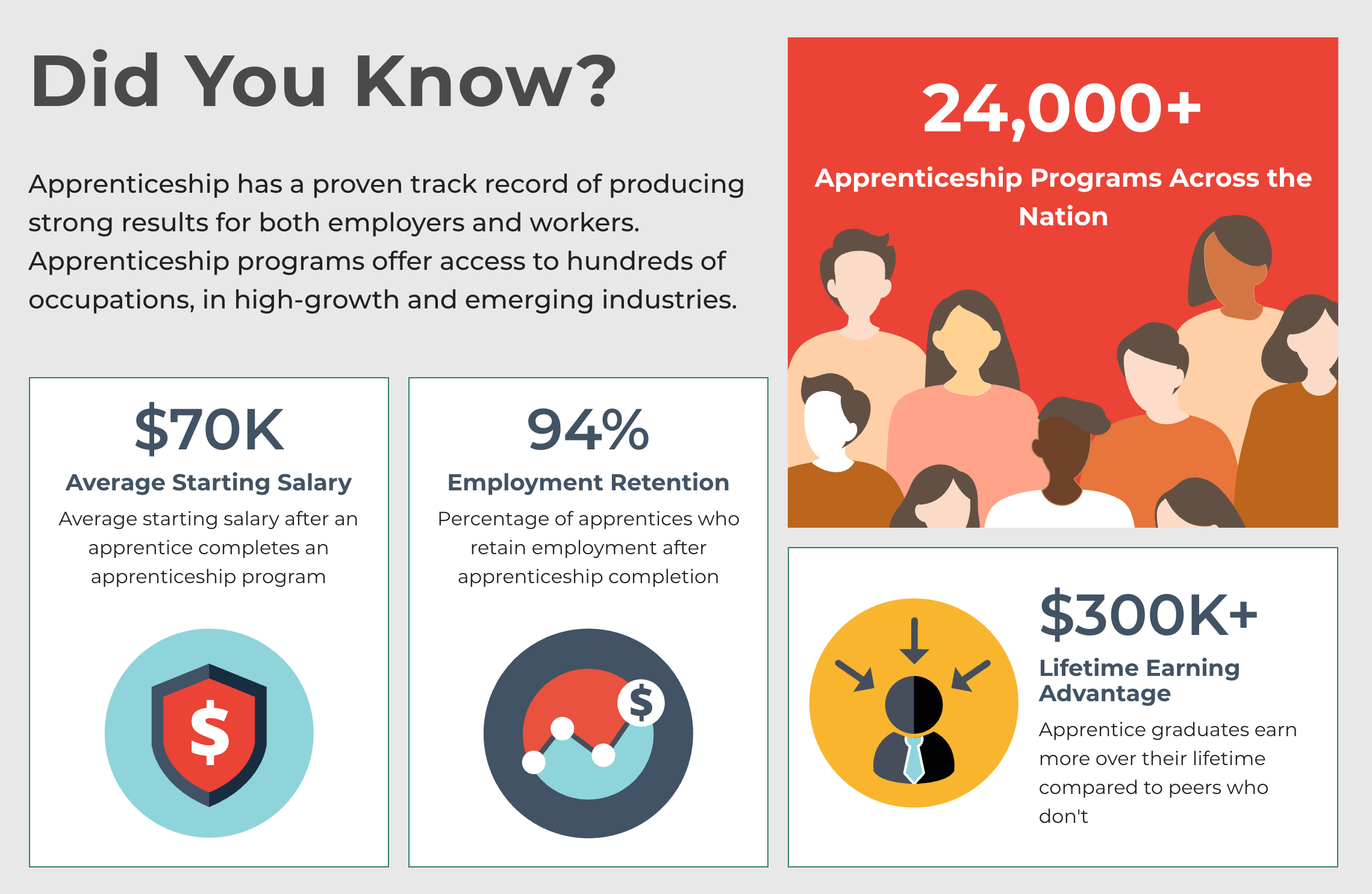

This proposed bill’s primary benefit is to help fund programs that provide training for the many skilled and workforce jobs that need to be filled in America. Not only does a business or individual benefit from the tax credit received, but the participants in these programs also gain access to opportunities they may not have been able to afford otherwise. Getting a person into a job right away that provides learning as they work is critical to advancement and growth. According to the Pennsylvania Department of Labor & Industry, “nearly 9 out of 10 apprentices are employed after completing their apprenticeship.” They also start their new employment with an average salary of $70,000 per year. To find out more about apprenticeships and training opportunities in PA visit Pennsylvania CareerLink.

In addition to apprenticeships, this bill also enables families, who may not have afforded it otherwise, to send their kids to good schools to receive a quality education and put them on the path towards a financially sustainable career. Programs like EITC in Pennsylvania, which this bill was modeled after, provide scholarship opportunities for families to send their kids to the school of their choice. Because EITC allows businesses to differ tax dollars to scholarship and educational improvement organizations, they can choose the good schools that get these additional donations, creating better competition resulting in better education. In a free-market society, competition pushes products to improve. The same is true in education. Where there is no competition, there is no incentive for improvement.

The government’s role is not to provide financial resources for the people. Its role is to promote opportunity so that a person who applies hard work and discipline can achieve financial stability and success. This bill creates the opportunity for United States citizens to get jobs and gain the experience and training needed to reach financial stability through solid employment. With time and hard work, this common-sense approach will build a more stable long-term economy. The key is getting people willing to work into jobs.

Leave a Reply